Netguru’s Approach to Fintech: How We Helped 14 Companies Build Successful Products

Almost half of consumers worldwide use an insurance fintech platform. And 88% of global finance leaders are afraid of losing business as a result of technological change.

As fintech expert Chris Skinner puts it, “Ignoring technological change in a finance system built upon technology is like a mouse starving to death because someone moved their cheese.” Organizations that wish to keep up with that change must be ready to innovate — or be left behind.

And it pays to have help.

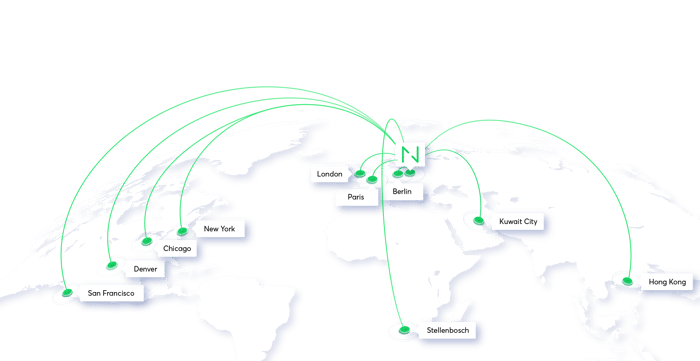

At Netguru, we’ve completed dozens of projects for fintech companies and big financial institutions from all over the world, from implementing payment APIs for Mastercard to creating scalable architecture for a budgeting app.

Read on to find out how Netguru can help you build tech solutions that will help you accomplish your business goals. Check out our approach to fintech product development, 14 of our top fintech products, and how we impact the fintech community through our events.

The Netguru Approach to Fintech Product Development

There’s no silver bullet for building a successful fintech product.

However, there are principles and frameworks that, when applied intelligently and consistently, help to guide each individual project to its unique outcome.

A few principles and frameworks that are particularly important to successful fintech development, in particular:

- Focus on the business needs. A successful engagement. At the start of every client engagement, we invest the time to understand the business, its values, and the goals and requirements of the project at hand - including the risks and unknowns. With that context, we are able to select the best development approach, tech stack, team and timeline for the project — keeping business value in mind each step of the way

- Agile project management. In a space that evolves as rapidly as fintech, you need an approach that enables you to test strategically and learn quickly — while keeping expectations clear and risks to the business under control. Striking the right balance between those factors is the driving force behind Netguru’s signature approach to agile project management, which is optimized for clarity, communication, and continuous improvement.

- Strong technology culture. The financial sector is taking advantage of an ever-expanding portfolio of innovative technologies, from AI and machine learning to blockchain consulting and advanced cybersecurity. Finance institutions need partners who understand these technologies on a deep level — which is why Netguru is committed to a culture of learning and technological excellence.

- Quality assurance. When dealing with something as essential as money, whether it’s a banking customer’s savings or a business’s payments infrastructure, there’s no room for error. Netguru has developed a robust framework for quality assurance to protect the project and the business’s success.

- Scalable projects. We know no two finance institutions’ needs are exactly alike. Some need full product teams that can step in and own a product from the idea stage until completion, while others need specialists in key areas to augment their internal team’s existing capabilities. Netguru’s Agile experience gives us the ability to provide that flexibility, and meet each business we work with where they are.

- Commitment to security. IT security is one of the top priorities among finance leaders. Money is both highly sensitive and highly personal, and customers need to know their financial information is safe with the institutions they trust. Netguru ensures rigorous adherence to security best practices in compliance with ISO 27001, OWASP and GDPR.

We’ve applied these frameworks across dozens of projects for fintech clients. The result: shorter development cycles, streamlined processes, increased revenues, and new or strengthened products that have delivered measurable ROI.

Now, let’s look at a few of the specific projects we have tackled for businesses looking to innovate in the fintech space:

1) Solarisbank – Implementing a New API for Mastercard

Solarisbank is a banking-as-a-service company that offers a tailored banking platform to each of its customers. They provide access to APIs that allow them to build products for payments and e-money, lending, bank accounts, KYC services, and algorithmic scoring. They also integrate with third-party providers.

The Berlin-based company is one of the hottest in fintech. In only four years, the company has raised over 100 million euros in funding and has hired over 200 people. As Solarisbank wanted to keep with their ambitions as a leading fintech company they tapped Netguru for help.

With a dedicated team of engineers, Netguru helped implement an API that orders, manages, and controls Mastercard credit cards. They also assembled a stand-alone team to build a platform just for handling debit cards using Ruby. Additionally, they used Elixir to strengthen the consumer loan products engine team.

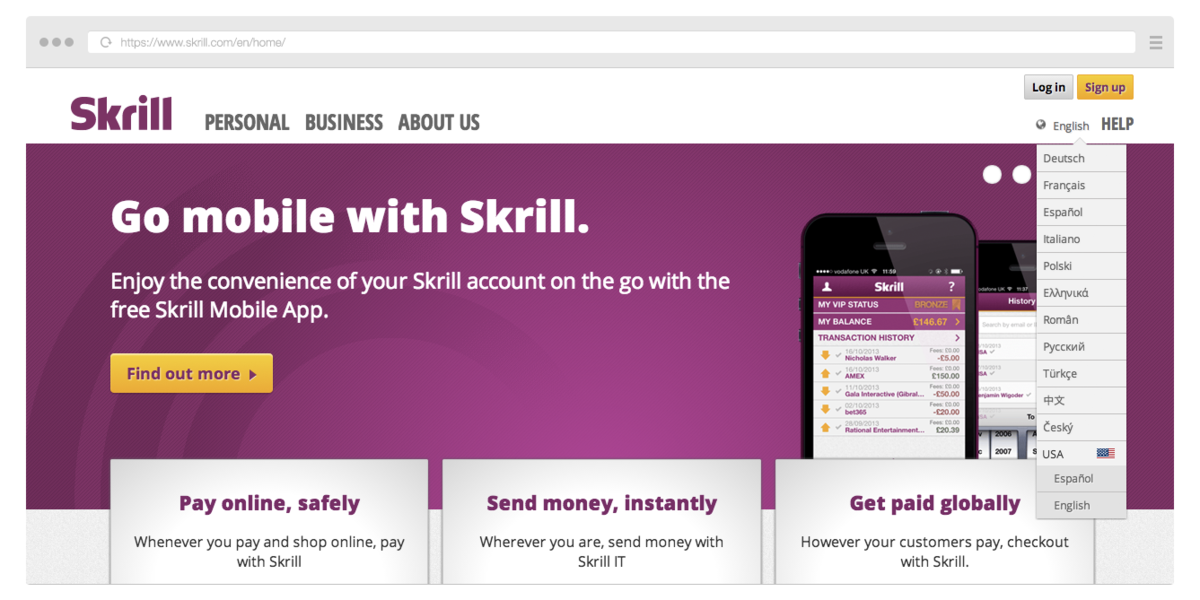

2) Skrill - Adding New Features to an Online Payments Platform

Skrill is one of the world's largest online payment and digital wallet providers. With over 20 million account holders, Skrill allows users to make online payments securely without revealing personal financial data.

Skrill needed to hire exceptional talent to build and implement new features quickly, maintain and expand a large code base, and, ultimately, keep up with their rapid growth.

To do so, they asked Netguru to implement user workflows with their preexisting API services, build an app for payment account management, and regularly implement new features and bug fix releases to Google Play and the App Store.

Today, Skrill now offers 100 payment options to securely send and receive money in 200 countries. Additionally, 40 currencies are available, the transaction cost is low, and users' financial details are not at risk.

3) Finiata - Building an Automated Invoice Factoring Software from Scratch

Finiata is a Berlin-based fintech startup specializing in automated invoice factoring. Its platform targets small and midsize enterprises, freelancers, and sole traders.

To move quickly in the hypercompetitive fintech industry, Finiata was looking for a new team to help its product development team swiftly build out all of its software.

After Finiata chose to partner with Netguru, they worked together for over a year. And less than eight months after their partnership, Finiata raised more than €20m in funding and attracted over 15,000 registered users, becoming one of the leading fintech companies in Germany.

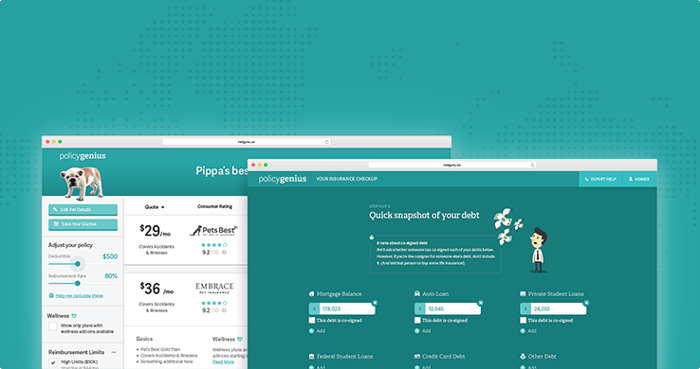

4) Policygenius - Adding New Features to an Insurance Provider App

Policygenius was founded in 2014 by two former McKinsey consultants to disrupt the insurance market. Its product Insurance Checkup allows users to pinpoint gaps in their coverage and review appropriate solutions.

Facing stiff competition in the NYC fintech market, Policygenius needed to build new, high-quality features on their platform within a tight deadline.

Netguru’s team of developers joined Policygenius’ team to develop and introduce functional surveys and the back-end implementation of disability insurance pricing model (including react components). As a result, Policygenius was able to secure $21.5 million in funding.

5) Moonfare - Scaling an Investment Platform That Offers Access to Top Private Equity Funds

Moonfare is an investment platform that enables people to invest in top private-equity funds. And to secure their first round of funding, they wanted to scale their application and design a top-notch user experience as their business grew.

To do so, they hired Netguru to rewrite their code from Sails.js to Node.js, design new interfaces and implement them using React.js, and configure the app’s entire architecture in AWS.

As a result, Moonfare was able to close their first funding round of $11 million. They also attracted widely recognized, big-name funds to their platform, such as The Caryle Group, Warburg Pincus, and EQT.

6) CashCape - Building a Financial Virtual Assistant App from Scratch

CashCape is an app that helps clients manage their personal finances by learning about their spending behavior and patterns and offering cheap short-term loans.

CashCape had to build their app from scratch, so they tapped Netguru to take the reins. During their partnership, they were able to integrate with an agency that could verify their customers' data, a private German bank that provided loans, and a partner that could verify their users' identities.

Netguru also helped CashCape secure the data of their users as the company imported their users’ banking data, verified their identities, sent their identity documents, and approved or denied their credit. Additionally, when designing the digital credit processes, Netguru's QA team found a lot of potential issues and stopped them before they could occur.

To date, CashCape has calculated thousands of loan requests.

7) Clarity - Completing an Unfinished Project for Software That Scans for Security Vulnerabilities and Legal Risks

Clarity scans binary files to detect security vulnerabilities, licensing information, and potential legal risks. Clarity tapped Netguru to complete an unfinished product, which needed close cooperation with Clarity’s team, had a lot of bugs, and had no functionalities that worked at full capacity.

Netguru's team provided their expertise, decisiveness, and advice on back-end web development and system architecture. They also refactored the existing code without any mishaps or delays. The product was finished by deadline and is ready to be used by corporations.

8) Santander - Building a Platform That Collects Customer Feedback to Improve Services

As one of the biggest banks in the world, Santander wanted to create an interactive crowdsourcing platform that could collect customer feedback about how they could improve their services. Netguru provided a team that took charge of the project at every stage and implemented the platform successfully.

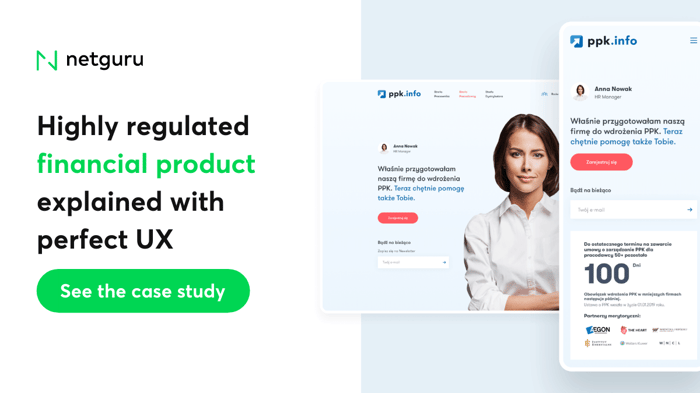

9) Aegon and The Heart - Building a Web Platform That Supports Pensions Plan Sales

Aegon is a multinational life insurance, pension, and asset management company.

In Poland, a parliamentary bill about a government-enforced long-term savings program called PPK was passed; it requires employers to pay an annual premium to each of their employees. This allows financial institutions to provide new savings-related products. However, the bill is highly regulated and complex, which creates a taxing amount of work and awareness for human resources teams.

Aegon recognized the need for a simple, clear source of information about PPK that HR managers could rely on, as well as selling their PPK services. So they partnered with The Heart, a corporate center for digital ventures, and Netguru to build a web platform called PPK.info to do so.

By working in agile, we were able to build a web platform that allows employees and employers to easily find information about PPK, submit questions, sign up for a newsletter, and calculate their PPK contributions. And since we added a lead-generation form to the platform and integrated it with Aegon’s CRM, their sales team was able to sell their PPK plans to the site’s visitors.

10) Dobot - Implementing a Scalable Architecture to a Financial App That Makes It Easy to Budget, Save, and Invest for the Things You Care About

Dobot is a mobile personal finance advisor that aimed to create a financial advising bot that was data-intensive and could directly manage a user’s bank account.

Netguru merged with Dobot’s team to implement a scalable architecture that they could add new features to whenever necessary. They also introduced bank-level security. My Dobot just came out of its proof-of-concept stage, but they’ve received a warm reception from their early adopters.

11) Endowus - Building an App for a Digital Investment Platform That Makes Investing Easy for Everyone

Endowus is an investment platform that houses all of their clients’ investment funds, public pensions, and private savings and offers investment products and financial advising to grow their wealth as much as possible.

The Singapore-based company is the first and only digital advisor for the Central Provident Fund, which is the country’s obligatory fund for their citizens’ retirement, health care, and housing needs.

To help build a user-friendly app that makes wealth management easy for everyone, Endowus tapped Netguru. They lent one of their designers to Endowus’ team to work on wide range of user experience, user research, and even some marketing projects.

12) Digital Wealth Solutions - Improving Financial Advisors’ Efficiency with a Digital Front Office

The personal trust between a client and their financial advisor can make or break their professional relationship. With a matter as important as almost anything else in their lives — wealth — clients will hand it over only to someone they trust. That’s why a human advisor is still preferred over robo-advisers, even though they’re more accessible and less expensive.

But with human advisors comes in-person consultations. And they can grind a firm’s efficiency to a halt.

Digital Wealth Solutions decided to strike a balance between these two extremes and marry the human element of financial advising with the digital nature of robo-advising. They aimed to create the first platform that could enable financial advisors to acquire clients, interact with them through private video meetings and chat, organize meetings, digital document signing, and document vaults, and manage costs — all while ensuring top-flight security of clients’ personal information.

In order to be the first to market, DWS partnered with Netguru to build a platform. And over the last three years, we’ve been able to collaborate during each stage of the development process, from prototyping to final deployment.

13) Payback - Redesigning a Customer Loyalty Application to Provide a More Consistent User Experience

As the world’s largest customer loyalty program, Payback integrates with most popular payment methods, allowing people to rack up points with their favorite brands and, in turn, earn rewards and discounts. This enables their partner brands to provide offers to their customers that build even more loyalty.

.jpg?width=700&name=Blog%20CTA%202%20(1).jpg)

Payback’s mobile and web applications are their most trafficked hubs. Naturally, their architecture and presentation layer developed into complex ones. As a result, they wanted to streamline the interface in a simpler, full-stack solution that would reduce friction while navigating their apps

Payback partnered with Netguru over a six-month period to redesign their applications’ architecture, build a consistent system that would help users easily find the information they were looking for, and build geolocations solutions for their partners.

14) Swap - Transforming the UX Design of a Rising Fintech Star in Mexico

In Mexico, most people pay for things in cash, and bank transfers also take up to two hours to process. That’s exactly why Swap, a P2P mobile payment app, wants to make transferring money in Mexico easier. Users can send funds to any of their contacts, any bank accounts, and any debit card numbers.

But since Swipe built their app internally three years ago, they discovered their interface version couldn’t handle the additional features being built onto it. As a result, their user experience suffered.

To introduce a brand new UI and UX and rebuild their app, Swap decided to partner with Netguru’s design team.

After conducting UX research to understand how users interacted with the app and building wireflows and user stories, Netguru added the finishing touches to the app. They didn’t want to jar current users, so they made subtle changes, like refreshing the fonts and color palettes and adding custom illustrations to clarify any abstract terms.

With their brand-new interface, Swap was able to build new features onto their app, such as social media money transfers, media payments, and Swap credit.

As of today, Swap processes $60 million per month for 85,000 users and recently closed a seed round of $1 million.

Netguru’s Impact on the Fintech Community

Besides helping fintech startups build their products, Netguru also actively engages in the fintech community by hosting regular Disruption Forum events both on-site and online.

Disruption Forum Berlin Fintech

In April 2018, we organized Disruption Forum Berlin Fintech, an event that featured experts who actively shape the fintech landscape. During the event, we engaged in a constructive discussion about the future of fintech and attracted 100+ top-level managers from German banks, representatives of fintech startups, industry influencers, and UX designers. The speaker list included:

- Dr Jörg Howein - Chief Product Officer at solarisBank

- Lars Markull - API Evangelist at figo

- Kuba Filipowski - Chief Strategy Officer at Netguru

- Meaghan Johnson - Customer Journey Expert and Consultant

- Lorenz Jüngling - Chief Product Officer at N26

Read about key takeaways from the event’s debate here.

Disruption Forum London

Encouraged by the conference’s success, Netguru decided to organize the second edition of Disruption Forum series -- this time at Level39 in London. We chose to host the event at Level39 because it’s one of the top startup accelerators in the world, spawning companies like Revolut, doPay, LootBank, and Capexmove.

At the event, we focused on how to create a fintech product that people will use on a daily basis. To learn how, we invited some of top experts from the fintech industry:

- Chad West, Head of Marketing and Communications, Revolut

- Martin Dowson, Head of Customer Labs, Lloyds Banking Group

- Ben Chisell, Product Director, Starling Bank

- Yannis Karagiannidis, Head of Growth, Monese

- Tom Eilon, Head of Commercial, Funding Circle

- Valentina Kristensen, Director, Growth & Communications, OakNorth

- Emmanuel de Cazotte, UK Country Manager at Lemon Way

Engaging in plenty of heated debates, our speakers came some to incredibly interesting conclusions. You can read about the key takeaways from the event in our article .

Disruption Forum New York

For the third edition of the Disruption Forum series, we hosted the event in one of the strongest fintech hubs in the world – New York City. Over 200 attendees were able to listen to 11 speakers from top fintechs like Betterment, Currencycloud, Dataminr, Ellevest, N26, OakNorth AI, Payoneer, Plaid, Revolut, Stash, and Transferwise about AI, building effective product teams, growth in fintech, and international expansion. The speaker list included:

- Katherine Kornas, Senior Director of Product, Betterment

- Melissa Cullens, Chief Design Officer, Ellevest

- Sudev Balakrishnan, Chief Product Officer, Stash

- Charley Ma, Growth Manager - New York City, Plaid

- Jody Perla, Managing Director, Payoneer

- Alex Jaimes, Chief Scientist and SVP of Artificial Intelligence, Dataminr

- Farrah Lakhani, Director of Growth and Operations, OakNorthAI

- Nicolas Kopp, U.S. CEO, N26

- Dan Westgarth, General Manager - North America, Revolut

- Arshi Singh, Head of Product - North America, Currencycloud

- Andrew Boyajian, Head of Banking - North America, Transferwise

Read all about the events’ takeaways here.

Disruption Forum Paris

In October 2019, we hosted our Disruption Forum event in Paris to explore key learnings and pain points in the fintech and insurtech space. Featuring top industry experts from leading startups, scale-ups, and fortune 500 companies, our speaker list included:

- Alex Prot, CEO & Co-founder, Qonto,

- Eric Mignot, CEO & Founder, +Simple

- Rodolphe Ardant, CEO & Founder, Spendesk

- Virginie Augagneur, Managing Director, platform58

- Caroline Lamaud, Co-founder, Anaxago

- Eric Sibony, CSO & Co-founder, Shift Technology

- Patrick Tsao, VP of Products, Getsafe

- Damien Philippon, COO & Founder, Zelros

- Paulina Jusis-Alfonsi, Chief Digital Culture Officer, Euler Hermes

- Olivier Jaillon, Chief Enablement Officer, La Parisienne Assurances

- Macha La Hausse de Lalouviere, Head of Sourcing, ARKEA

- Jonathan Denais, Managing Director, CNP Assurances

- Paola Fedou, Data Scientist, AXA Climate

- Stephane Guinet, CEO & Founder, Kamet

- Louis Carbonnier, Co-CEO & Founder, Hokodo

- Florian Graillot, Co-founder, Astorya.vc

Our talk tracks covered everything from scaling, venture building, machine learning disrupting the insurance industry, and cracking the insurance distribution.

Disruption Forum Insurtech

This year, our Disruption Forum series was a little different than our previous editions. Due to the Coronavirus pandemic, we decided to host a remote event about how leading insurance companies are using AI. To do so, we sat down and chatted with four experts in Insurtech:

- Dan Donovan, Head of Customer Success, Shift Technology

- Wenling Yao, Head of Business Intelligence, Clark

- Paweł Jarmołkowicz, Data Science, Netguru

- Grzegorz Mrukwa, Senior Machine Learning Engineer, Netguru

From learning how AI and analytics can impact your KPIs to implementing AI for maximum value to building an application Proof of Concept in 2-4 weeks, check out the main takeaways about each topic here.

Netguru’s Involvement with the Developer’s Community

Netguru also supports the developer’s community. Together with our friends from CashCape, we took part in Bankathon Berlin to build an app from scratch and demonstrate how to use PSD2 in software. We had 30 hours to complete this task. The joint team of CachCape and Netguru developers created an identity-related application and won two prestigious prizes:

- Identity Category Winner

- Special Prize from the Association of German Banks

You can read more about it here.

Building Your Fintech Product with Netguru

As you can see, at Netguru, we’ve completed dozens of projects for fintech companies and big financial institutions with satisfactory results and hosted events that have made a substantial impact on the fintech industry. We hope the examples above can help you decide whether you’d like to partner with us to build your next fintech product. Be sure to drop us a message, and speak with our experts!

-1.png?width=50&height=50&name=Aleksandra_Paszkiewicz_1_square%20(1)-1.png)

%20_HD.jpg?width=384&height=202&name=DSC_7274%20(1)%20_HD.jpg)