Top 11 Fintech Companies in London to Watch in 2020 [Updated]

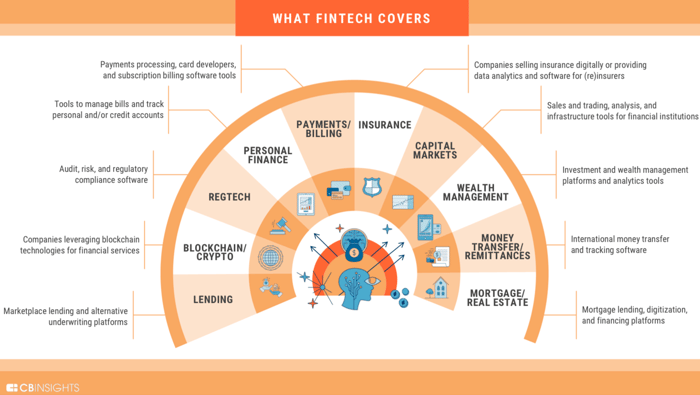

Around the world, a whole host of both emerging and established fintech companies are creating innovations across online and mobile payments, big data, alternative finance, financial management, and many other corners of the finance industry. Globally, the total value of fintech investments topped $24.6 billion through Q3’19, already surpassing 2017’s total, according to CB Insights’ Global Fintech Report Q3 2019.

(Image source: cbinsights.com)

With the financial industry largely being associated with some of the biggest companies in the world – banks and other financial institutions make up a significant proportion of the Fortune 500, for example – one might expect these giants to also be the driving force in the fintech industry as well. However, such is the extent of startup disruption, according to PwC, 88 percent of global leaders at incumbent financial institutions see standalone fintech companies as a threat to their existing business models.

As such, what we are seeing is a landscape where small startups can compete on the same level as established finance behemoths – even in a fiercely competitive market such as London, where we will be focussing our attention in this article.

The UK capital is indeed one of the most exciting fintech hubs in the world.

But who are the big players, what are their solutions, and what do they have planned for the year ahead? Read on then fintech pilgrim as we look at twelve London-based fintech brands you should be watching over the coming year.

1. TrueLayer

By supporting other financial brands with its proprietary API, TrueLayer allows smaller startups to access banking data while avoiding the need to build and design their own systems.

In 2018, TrueLayer secured $7.5 million in funding to expand into Europe. A further $35 million was secured in 2019 from Tencent, Temasek, and other backers to expand its ‘Open Banking network’ in and outside of the region. This brings its total funding to date to $46.8 million – not bad for a brand that has only been around since 2016.

“ Open Banking is about much more than liberalizing the finance industry to increase competition and reduce costs,” said Cofounder and CEO of TrueLayer, Francesco Simoneschi. “It is also about raising security standards and protecting consumers and businesses. Online fraud ripples out and raises costs for everyone making card payments.”

TrueLayer has already launched a beta of its own Payments API to enable businesses to start accepting payments through Open Banking, and has also signed partnership deals with Zopa, BitBond, ClearScore, and Anorak, amongst many others. With so many new markets to enter and potential partners to work with, TrueLayer has the potential to gain even more business in 2020, as well as continuing to refine its offering.

2. Starling Bank

Scooping up no fewer than three gongs at the 2019 Smart Money People British Bank Awards – Best British Bank, Best Business Banking Provider, and Best Current Account Provider – app-only challenger bank Starling Bank has certainly been making an impact on the UK financial scene since it received its banking licence in 2016.

Starling was the first brand in the UK to launch a mobile-only current account and also offers business accounts – something its rivals are still working on. Starling has all the features you’d expect from a high street bank – money management tools, a contactless debit card, and 24/7 support – without the baggage of a physical presence.

Today, Starling Bank is drawing tantalizingly close to £1 billion in deposits and, according to Founder and CEO, Anne Boden, expects to start turning a profit in 2020.

“We, as usual, like to do things differently – the Starling way,” said Boden. “And what we’re doing now is expanding our product range and innovation hand in hand with growing our businesses, with a clear path to reaching profitability.”

Expect 2020 to see international expansion for Starling Bank. It’s already working towards an expansion into Ireland, having recently opened a Dublin office, and is recruiting its first international employees. In Europe, Starling has its sights set on the Netherlands, France, and Germany – so watch this space for big things from this innovative fintech.

3. Monzo

We would be remiss to have Starling Bank in our list and not also include its nearest competitor – Monzo. Proud winners of the Best Banking App gong at the Smart Money People awards, Monzo is regularly discussed in the same conversations as Starling, and was only 0.2 percent behind its rival, claiming second place in this year’s Banking League Table of customer satisfaction scores.

First entering the challenger bank scene in 2015, Monzo had a firm focus on creating an intuitive banking experience for customers who were tired of the endless forms, hidden fees, and charges associated with traditional financial institutions.

Monzo is presently responsible for around $1.1 billion in deposits and, while most banks lend out most of the millions they are looking after, none of the cash at Monzo is being gambled with, traded, or divvied up into financial instruments. Instead, Monzo opts to simply store all of its deposits in the Bank of England.

“On a spectrum of risk,” said CEO Tom Blomfield, “we’re literally the safest bank you could possibly imagine, because the money just sits in the central bank. It seems bizarre. Anyone from another bank who looks at our balance sheet just scratches their head. They can’t understand it. Unless the UK fails as a country, that money is safe.”

In early 2019, Monzo raised £113 million from a Californian investment group, prompting a new marketing strategy from the disruptive startup. While the majority of Monzo’s customer base were young males in the London area, a recent campaign targeting older consumers prompted the opening of 260,000 new accounts in a single month.

4. Nutmeg

Using digital technology to open up investment opportunities, Nutmeg thinks it’s a fintech with a big difference. Instead of relying on complex algorithms to make decisions on behalf of its customers, Nutmeg employs…wait for it…human beings to perform this role. Users define targets and set the level of risk they’re comfortable with before Nutmeg’s team present them with portfolio options.

Founded in 2011, Nutmeg has seen significant growth during 2019. At the close of 2018, the investment platform had 40,000 customers, rising to over 50,000 by mid-2019. Banking giant Goldman Sachs invested in Nutmeg at the top of 2019, leading a funding round of $58 million.

Recently, Nutmeg leveraged the power of crowdfunding and acquired investment totaling £2.5 million from private investors – 250 percent of its target. Following the campaign, approximately one percent of Nutmeg is now owned by clients of the Crowdcube crowdfunding platform.

“Our customers are our greatest advocates and we wanted to give them an opportunity to invest in, as well as with, a business they’ve helped to make a success,” said Nutmeg CEO and Director, Martin Stead.

Nutmeg is seeking to expand into Asia and has recently launched a partnership with Taipei Fubon Bank to help it in this mission.

5. Funding Circle

As one of the UK’s three big peer-to-peer lenders – and the first to go public – Funding Circle claims to have helped nearly 50,000 small to medium-sized UK businesses achieve their objectives through borrowing a total of £5 billion on its platform.

Funding Circle has had some ups and downs since it went public but recently announced a record year with loans under management hitting £3.7 billion and a 13 percent leap in share price.

“In the third quarter, loans under management reached £3.7 billion and projected returns for 2019 continued to show an improvement over recent years,” said co-founder and CEO, Samir Desai. “We continue to manage the business prudently, which we are confident is the right course of action for the long-term growth and development of our business.”

Funding Circle pairs amateur lenders with small loan-takers and allows the former to sell off parts of the loan if and when they wish to cash out. However, this can be a slow process, with some lenders reporting that it can take up to three months to complete.

To combat this, Funding Circle has recently launched a new tool that will make it easier and quicker to sell off loan parts. Loans were sold on a first-come, first-served basis, with investors having to wait until they reached the top of the queue. With the new tool, loans will be continuously cycled over a 120-day period, allowing investors to receive money back on a more regular basis.

6. Monese

Another digital disruptor in the banking space, Monese has been offering current accounts and money transfers to tech-savvy consumers since 2013. While it may often sit in the shadow of other startups on this list, Monese has a solid reputation for its quick and simple application process.

People in 20 different countries can open a Monese account and the brand has recently joined up with fraud intelligence agency Cifas to help fight the global issue of financial fraud. Monese has a firm focus on providing a quality service and inspires the kind of trust and confidence consumers look for in a financial partner.

“For Monese, we would love to provide a more complete financial ecosystem for our customers, with more features and partnerships available to them,” Head of Growth at Monese, Yannis Karagiannidis, told Netguru recently.

In September 2019, Monese raised a massive $60 million in series B funding. The round was led by Kinnevik, with additional participation by big financial brands such as PayPal. The company also plans to hire an additional 100 employees across its existing UK and Estonian offices, as well as open a third new office in Portugal by the end of 2019. With a growing infrastructure and more cash in its pocket, we’re excited to see what 2020 has in store for Monese.

7. Receipt Bank

Offering its clients cloud computing combined with AI and data handling, Receipt Bank saves time and effort by enabling the automatic compilation of accounts and expenses. Opened in 2010, the brand has expanded rapidly from its home in London to include France, Australia, and the US.

Users are able to download spreadsheets and reports with ease and integrate the platform with their existing cloud accounting software. The Receipt Bank solution is simple to implement and has been well-received by clients with the brand experiencing seven years of continuous growth.

In 2020, Receipt Bank will be putting on Receipt Bank Exchange 2020, a tailor-made event for the finance industry. The event will give industry professionals the chance to exchange ideas and best practices while also providing unmissable networking opportunities.

“Receipt Bank Exchange will feature inspirational keynotes, thought-provoking panels and insightful discussions led by industry visionaries,” says the company. “Receipt Bank’s Chief Product Officer will fly in from London to share the latest product updates and roadmap. We will finish the day off with our first-ever Awards night where we'll celebrate accountants and bookkeepers paving the way for our industry.”

8. Trussle

The mortgage space is one that has traditionally found itself resistant to digital transformation, as even the most digitally-savvy customers still prefer to speak face-to-face when shopping for a mortgage product. However, online broker Trussle and its mortgage comparison platform seems to be breaking that mold wide open.

Trussle scans more than 90 different lenders and compares over 11,000 deals to find customers the best mortgages available. Not only this, but Trussle continuously monitors the market post-sale as well, helping its clients identify and switch to better deals further down the line.

Trussle has recently hired former CTO and cofounder of credit card fintech Wallaby Financial, Todd Zino, as its new CTO. Bringing over 20 years of experience across multiple countries and product areas, Zino’s remit is to drive innovation, shake up the industry, and further develop and revolutionize the Trussle offering.

“In an era where new Open Banking, property valuation, and underwriting APIs are being launched frequently, there’s an incredible opportunity for us to completely revolutionize the mortgage process for consumers,” said Zino.

9. Cleo

Chatbots have massively risen in popularity over the last few years thanks to the advances in sophistication of artificial intelligence software.

Into this space steps Cleo, an AI chatbot that connects with users via their Facebook account and helps them manage their finances better. Using the platform, users can track expenditure and savings – helping them save money and plan for the future.

Originating in the UK and having recently expanded into the US, Cleo is boasting over 1,000 new signups each day, with plans to expand into other English-speaking countries including Canada, Australia, New Zealand, Ireland, Singapore, and South Africa in 2020.

Cleo founder and CEO, Barney Hussey-Yeo, says that it is better to focus on building a better and smarter UI/UX than re-inventing the current account itself, even if the ultimate goal is somewhat the same. “Nobody needs to be a bank to replace your banking app,” he says.

10. Curve

We’ve all experienced the problem of having too many cards and fumbling to find the right one at the supermarket checkout. Like all good fintech apps, Curve spotted this common problem and designed an elegant and simple solution to resolve it.

With Curve, consumers can access all their cards via a single card-and-PIN combination, doing away with the need to have a wallet stuffed with thick wads of plastic. You can even switch payment options after the event, moving a past purchase from one card to another.

“Curve is to Banking what Netflix is to TV and Spotify to Music,” says Curve. “We connect all your cards in one smart card. And one even smarter app. We bring you financial freedom and endless opportunities. All in one place. What isn’t there to love?”

Curve recently raised a further $55 million in funding and announced plans to expand its offering to six other European countries and the US by the end of 2020. The company has also just partnered with Samsung Pay to launch its first purely mobile offering. Things are looking good for Curve in 2020.

11. Revolut

Using prepaid cards and peer-to-peer payments, Revolut is providing yet another digital alternative to traditional banking. Revolut is also one of the few brands to jump on board the blockchain train and supports several cryptocurrencies on its platform.

While 2018 was a great year for Revolut – securing one million customers in the UK and unveiling plans to launch in North America, Hong Kong, Australia, Singapore, and New Zealand – 2019 saw bad press hound the startup. Accusations of poor compliance, as well as a toxic startup culture, forced Revolut to go on the defensive and try to protect its brand image.

2020 is set to be a year of renewed vigour for the brand as it plans to launch in up to 24 new markets and hire 3,500 new staff, thanks to a new partnership with payment services giant and card issuer, Visa. After more than quadrupling its revenue to £58.2 million in the year ending December 2018 – from £12.8 million in 2017 – the challenger bank expects revenues to triple again this financial year.

Over 800,000 new customers joined Revolut in August and September 2019, bringing the total up to more than seven million across Europe and the UK. The company is now recording an average of 3.7 million monthly active users, and an average of 1.1 million daily active users, with transaction volume shooting up to $85 billion since its 2015 launch.

"The leap forward in revenue, and customer numbers, since the beginning of 2019, shows that the reason we started this business continues to be vindicated: to meet the major untapped need to solve the problems so many of us have with money management,” said Nikolay Storonsky, founder and CEO of Revolut. “2019 is set to be another year delivering record growth, but our work is not done and we are determined to reach all those who need us. This means maintaining our ambitious growth and expansion plans, which are now fuelled by substantial improvements to our profitability, and the key appointments we’ve been making.”

Storonsky added that his ambition is for Revolut to “exceed a $10 billion valuation” at some point.

Fintech in London – Final Thoughts

There you have our eleven big London-based fintechs to keep your eye on during 2020. These innovative brands are helping disrupt the industry and drive it forward, often turning traditional banking and financial services on their heads in the process.

Balancing digital connectivity with a human touch is key to fintech success, and it’s the brands that accomplish this that will have the greatest chances of achieving it.